74th Annual Meeting Report

As a valued member-owner of AOD, we encourage you to read the report to stay in the know about your credit union! Learn More

Insight Issue Insight Issue |

Issue Date | |

|---|---|---|

| 3rd Quarter 2024 | July 1st, 2024 | Download |

| 2nd Quarter 2024 | April 1st, 2024 | Download |

| 1st Quarter 2024 | January 1st, 2024 | Download |

| 4th Quarter 2023 | October 1st, 2023 | Download |

| 3rd Quarter 2023 | July 1st, 2023 | Download |

| 2nd Quarter 2023 | April 1st, 2023 | Download |

| 1st Quarter 2023 | January 1st, 2023 | Download |

| 4th Quarter 2022 | October 1st, 2022 | Download |

| 3rd Quarter 2022 | July 1st, 2022 | Download |

| 2nd Quarter 2022 | April 1st, 2022 | Download |

| 1st Quarter 2022 | January 1st, 2022 | Download |

| 4th Quarter 2021 | October 1st, 2021 | Download |

| 3rd Quarter 2021 | July 1st, 2021 | Download |

| 2nd Quarter 2021 | April 1st, 2021 | Download |

| 1st Quarter 2021 | January 1st, 2021 | Download |

| 4th Quarter 2020 | October 1st, 2020 | Download |

| 3rd Quarter 2020 | July 1st, 2020 | Download |

| 2nd Quarter 2020 | March 1st, 2020 | Download |

| 1st Quarter 2020 | January 1st, 2020 | Download |

| 4thQuarter 2019 | October 1st, 2019 | Download |

| 3rd Quarter 2019 | July 1st, 2019 | Download |

| 2nd Quarter 2019 | March 1st, 2019 | Download |

| 1st Quarter 2019 | January 1st, 2019 | Download |

| 4th Quarter 2018 | October 1st, 2018 | Download |

| 3rd Quarter 2018 | July 1st, 2018 | Download |

| 2nd Quarter 2018 | April 1st, 2018 | Download |

| 1st Quarter 2018 | January 1st, 2018 | Download |

| 4th Quarter 2017 | November 1st, 2017 | Download |

| 3rd Quarter 2017 | July 1st, 2017 | Download |

| 2nd Quarter 2017 | April 1st, 2017 | Download |

| 1st Quarter 2017 | January 1st, 2017 | Download |

| 4th Quarter 2016 | October 1st, 2016 | Download |

| 3rd Quarter 2016 | July 1st, 2016 | Download |

| 2nd Quarter 2016 | April 1st, 2016 | Download |

| 1st Quarter 2016 | January 1st, 2016 | Download |

| 4th Quarter 2015 | October 1st, 2015 | Download |

| 3rd Quarter 2015 | July 1st, 2015 | Download |

| 2nd Quarter 2015 | April 1st, 2015 | Download |

| 1st Quarter 2015 | January 1st, 2015 | Download |

| 4th Quarter 2014 | October 1st, 2014 | Download |

| 3rd Quarter 2014 | July 1st, 2014 | Download |

| 2nd Quarter 2014 | April 1st, 2014 | Download |

| 1st Quarter 2014 | January 1st, 2014 | Download |

| 4th Quarter 2013 | October 1st, 2013 | Download |

| 3rd Quarter 2013 | July 1st, 2013 | Download |

| 2nd Quarter 2013 | April 1st, 2013 | Download |

| 1st Quarter 2013 | January 1st, 2013 | Download |

| 4th Quarter 2012 | October 1st, 2012 | Download |

| 3rd Quarter 2012 | July 1st, 2012 | Download |

| 2nd Quarter 2012 | April 1st, 2012 | Download |

| 1st Quarter 2012 | January 1st, 2012 | Download |

| 4th Quarter 2011 | October 1st, 2011 | Download |

| 3rd Quarter 2011 | July 1st, 2011 | Download |

| 2nd Quarter 2011 | April 1st, 2011 | Download |

| 1st Quarter 2011 | January 1st, 2011 | Download |

| 4th Quarter 2010 | October 1st, 2010 | Download |

| 3rd Quarter 2010 | July 1st, 2010 | Download |

| 2nd Quarter 2010 | April 1st, 2010 | Download |

| 1st Quarter 2010 | January 1st, 2010 | Download |

As a valued member-owner of AOD, we encourage you to read the report to stay in the know about your credit union! Learn More

As a valued member-owner of AOD, we encourage you to read the report to stay in the know about your credit union! Learn More

For the past 73 years AOD Federal Credit Union has been serving ourmembers which we consider our AOD Family. And like the original 45members that

As a valued member-owner of AOD, we encourage you to read the report and watch the annual meeting video to stay in the know about

Lower your student loan monthly payments with AOD Federal Credit Union! Refinance today to reduce your interest rate and extend your payment period on your

We are proud to announce the 2021 AODFCU Scholarship Award Winners! Congratulations, Seniors! We know you will go far! See the winners!

Pre-qualify for your DREAM HOME TODAY! Mortgage Loans are a big part of what we do every day at AOD Federal Credit Union. It’s our

We are thrilled to announce that we will be expanding membership opportunities to 61 new underserved census tracks located within 10 new counties in East

Find out more about how we are responding to the Coronavirus (COVID-19) situation by clicking here. All AOD Federal Credit Union branch lobbies are now open to serve members in a

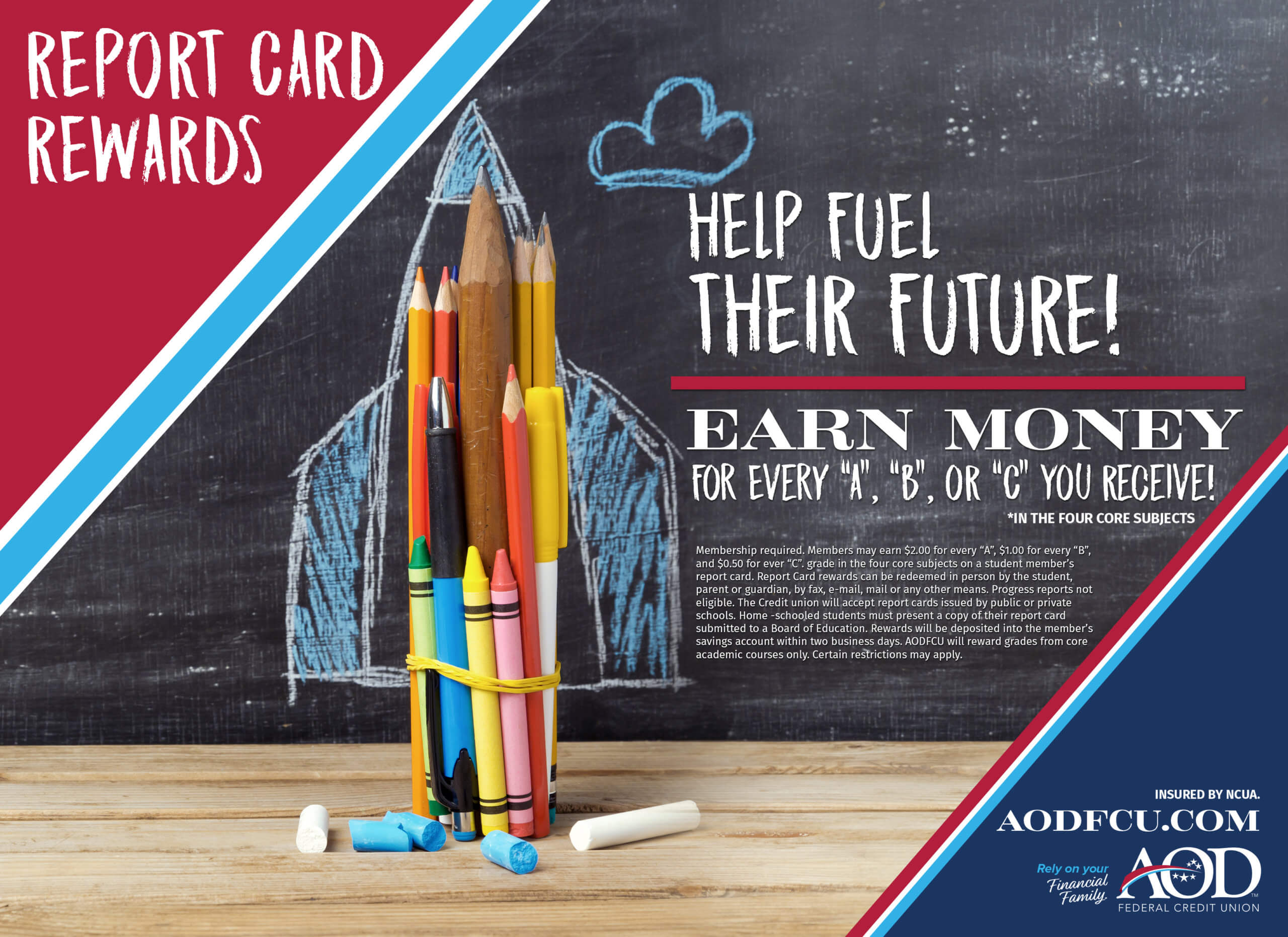

AOD Federal Credit Union is taking steps to ensure that being a youth member is more rewarding than ever before. AODFCU believes in investing in

AOD Federal Credit Union’s Board of Directors proudly presented the Community Developer Enabler, Inc. with a $1,000 donation. The funds will be used at the Sable Learning Center for children in Hobson City. The Sable Learning Center is a free afterschool and summer program that provides children with a meal and additional education away from school.

AOD Federal Credit Union’s Board of Directors proudly presented the Allan Ray Chaffin Marine Corps League with a $2,000 donation for their “Toys for Tots” project.

As tax season approaches, many of us find ourselves excited about the arrival of our tax refunds. It’s a chance to indulge in a little

As a valued member-owner of AOD, we encourage you to read the report to stay in the know about your credit union! Learn More

In the world of small business, all decisions can significantly impact your success. Everything plays a vital role, from the financial choices you make to the

If you’re having problems making payments on an auto loan or lease, contact your lender or servicer as soon as possible to ask what options

We often focus on our physical and mental health when considering well-being. However, it’s essential to recognize that our financial well-being also plays a huge

Repossession of property is not a popular topic to discuss – unless you are a fan of the (2007-2014) TV series “Operation Repo” or similar

Children ages 3 to 5 are usually too young to understand abstract financial concepts. Still, they are building a foundation that can serve them well

⚠️ Only scammers will tell you to buy a gift card, like a Google Play or Apple Card, and give them the numbers off the

⚠️ Only scammers will tell you to buy a gift card, like a Google Play or Apple Card, and give them the numbers off the

⚠️ Predatory 🏠 mortgage lending, whether undertaken by creditors, brokers, or even home improvement contractors, involves engaging in deception or fraud, manipulating the borrower through

Federally Insured by the NCUA. Your savings federally insured to at least $250,000 and backed by the full faith and credit of the United States Government. National Credit Union Administration, a U.S. Government Agency. NMLS# 519897.